The cost of a root canal with insurance can vary significantly depending on several factors, including the type of insurance plan you have, the specifics of your coverage, and the tooth being treated. Here’s a breakdown of what you can generally expect when it comes to root canal costs with insurance:

Average Costs with Insurance

- Front Teeth (Incisors)

- Without Insurance: Typically ranges from $300 to $1,500.

- With Insurance: Patients may pay between $100 and $600 out-of-pocket, depending on their coverage.

- Premolars

- Without Insurance: Costs usually range from $400 to $1,800.

- With Insurance: Out-of-pocket expenses can be around $200 to $800.

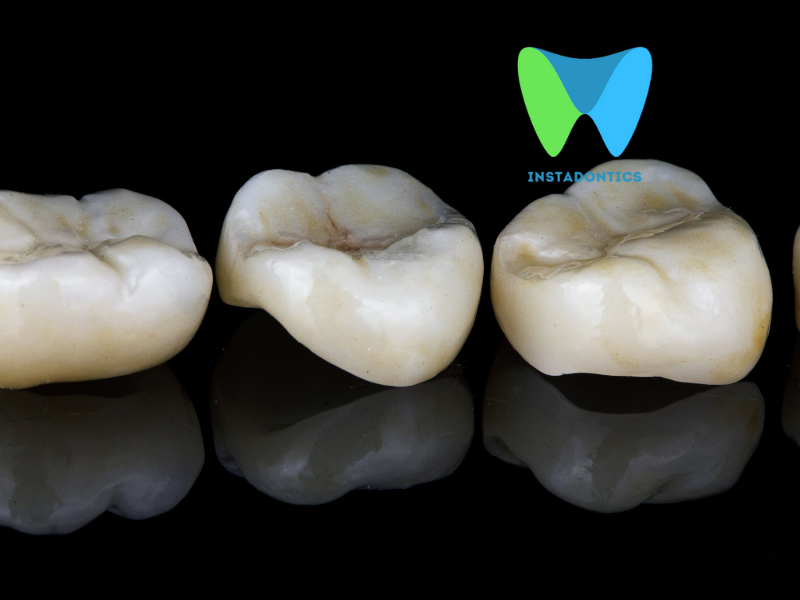

- Molars

- Without Insurance: The cost can range from $600 to $2,000 or more.

- With Insurance: Patients often pay between $300 and $1,200 after insurance coverage.

How Insurance Works for Root Canals

- Coverage Percentage: Most dental insurance plans cover a percentage of the cost of a root canal, typically between 50% and 80% after any applicable deductibles are met. This means that if your plan covers 70% of the procedure, you would be responsible for the remaining 30%.

- Deductibles: Many dental insurance plans have an annual deductible that must be met before insurance starts covering procedures. For example, if your deductible is $100 and the root canal costs $1,000, you would pay the first $100, and then your insurance would cover the agreed-upon percentage of the remaining amount.

- Maximum Coverage Limits: Most dental insurance plans have an annual maximum limit on how much they will pay for dental services. This limit can range from $1,000 to $2,000 per year. If you have other dental work done in the same year, this limit could affect how much coverage you receive for your root canal.

Factors Affecting Costs with Insurance

- Type of Insurance Plan: The specific type of dental insurance plan (PPO, HMO, etc.) can influence how much you pay. PPO plans often provide more flexibility with providers and higher coverage percentages.

- Network Providers: Using an in-network dentist can result in lower out-of-pocket costs compared to an out-of-network provider. Insurance companies negotiate rates with in-network dentists, which can lead to significant savings.

- Pre-Authorization: Some insurance plans require pre-authorization for certain procedures, including root canals. It’s essential to check with your insurance provider to understand their requirements and ensure that the procedure will be covered.

Let’s delve deeper into the cost of a root canal with insurance, including additional factors that can influence expenses, tips for maximizing your insurance benefits, and what to do if you encounter high out-of-pocket costs.

Detailed Breakdown of Costs with Insurance

1. Understanding Your Insurance Plan

Before undergoing a root canal, it’s crucial to fully understand your dental insurance plan. Here are some key components to consider:

- Annual Maximum: As previously mentioned, most dental insurance plans have an annual maximum limit. This is the total amount the insurance will pay for all dental services within a year. If you have already reached this limit due to other treatments, you may need to cover the entire cost of the root canal out-of-pocket.

- Coinsurance: This refers to the percentage of the cost you are responsible for after meeting your deductible. For example, if your plan covers 70% of the procedure, you will pay the remaining 30%.

- Waiting Periods: Some plans have waiting periods for specific procedures, especially for major services like root canals. If you recently enrolled in a plan, check if there’s a waiting period that may delay coverage for your procedure.

2. Cost Variations by Location

The cost of dental services, including root canals, can vary significantly based on geographic location. Urban areas tend to have higher costs due to increased overhead for dental practices. Here’s how location impacts pricing:

- Urban vs. Rural: In metropolitan areas, the average cost of a root canal may be higher due to the cost of living and demand for dental services. Conversely, rural areas may offer lower prices.

- State Regulations: Some states have regulations that can affect dental fees. Researching typical costs in your state can provide a clearer picture of what to expect.

3. Additional Costs to Consider

When budgeting for a root canal, consider the following potential additional costs:

- Consultation Fees: Some dental offices charge a fee for the initial consultation, which may not be covered by insurance. This fee can range from $50 to $150.

- X-rays: Diagnostic imaging, such as X-rays, may be necessary before the procedure. These costs can add an additional $50 to $200 to your total bill, depending on the number and type of X-rays required.

- Follow-Up Visits: After a root canal, you may need follow-up visits for monitoring or additional treatments, such as placing a crown. These visits can incur additional costs.

- Crown Placement: If your dentist recommends placing a crown after the root canal, this can add another $800 to $3,000 to your total costs, depending on the materials used and the complexity of the crown.

Tips for Maximizing Your Insurance Benefits

- Pre-Authorization: If your insurance requires pre-authorization for a root canal, ensure you obtain this before proceeding. This step can help confirm coverage and reduce unexpected costs.

- Choose In-Network Providers: Always check if your dentist is in-network with your insurance plan. In-network providers have negotiated rates with insurance companies, which can lower your out-of-pocket expenses significantly.

- Understand Your Benefits: Review your insurance policy to understand what is covered, including any limitations on coverage for root canals. This knowledge will help you anticipate costs and avoid surprises.

- Ask About Payment Plans: If you face high out-of-pocket costs, ask your dentist if they offer payment plans or financing options. Many practices provide flexible payment solutions to help patients manage their dental expenses.

- Utilize Health Savings Accounts (HSAs): If you have an HSA, consider using those funds to pay for your root canal. HSAs allow you to use pre-tax dollars for medical expenses, providing a financial advantage.

What to Do If You Encounter High Out-of-Pocket Costs

If the out-of-pocket costs for your root canal exceed what you anticipated, consider the following steps:

- Discuss with Your Dentist: Talk to your dentist about your concerns regarding costs. They may be able to suggest alternative treatment options or adjust the treatment plan to fit your budget.

- Negotiate Costs: Some dental offices may be willing to negotiate fees, especially if you are paying out-of-pocket. Don’t hesitate to ask if there are options for reducing costs.

- Seek a Second Opinion: If you receive a high estimate for a root canal, consider seeking a second opinion from another dental provider. Different dentists may offer varying estimates based on their experience and the complexity of your case.

- Explore Dental Schools: Dental schools often provide treatment at reduced rates, as students perform procedures under the supervision of experienced faculty. This option can be a cost-effective way to receive dental care, including root canals.

- Look for Discounts or Promotions: Some dental practices offer promotions or discounts for new patients or specific procedures. Keep an eye out for these opportunities, especially if you have flexibility in timing your treatment.

The cost of a root canal with insurance can vary widely based on your specific plan, the tooth being treated, and whether you use an in-network provider. On average, patients can expect to pay anywhere from $100 to $1,200 out-of-pocket after insurance coverage. To get the most accurate estimate, it’s advisable to contact your dental insurance provider and discuss your coverage details before undergoing the procedure. Additionally, consulting with your dentist can provide insight into the costs involved and help you understand your financial responsibilities.

Understanding your insurance benefits, exploring cost-saving options, and communicating with your dental provider can help you manage the financial aspects of a root canal effectively. If you anticipate needing a root canal, take the time to research and prepare, ensuring that you can navigate the costs with confidence and minimize any financial burden.